By Phani Tangirala

Practice Head - Insurance, Treasury & Capital Markets

Thinksoft Global Services

Practice Head - Insurance, Treasury & Capital Markets

Thinksoft Global Services

It could be said that eighty percent of global IT transformation

projects in insurance companies are not successful. No

exaggeration if ‘Success’ is not just a question of going LIVE.

Though projects start with the objective of aligning technology

with corporate growth enroute there is such turmoil that just

going LIVE is often viewed as an objective in itself. Needlessly

such situations do upset business users.

Let’s examine some very common concerns that persist after

going LIVE.

Business Users

• System is very slow

• Transactions now involve more steps compared to legacy systems

• Reports are missing

• With the new system financial books are in mess

• Too many change requests are now being received for enhancing the software

• It worked in UAT but not in production

• The vendor fixed one problem which then reopened an older one

• Documentation/User manual is not good enough

• This is a basic requirement, yet the vendor says it’s a change request

• Introducing new products is difficult and needs code change

Common complaints from software developers

• Users do not specify their requirements in total, we always receive one line requirements

• Our application is working fine, it’s the data from legacy which is giving problems

• They agreed to use canned reports, but now they want reports in their own format.

• Users never read documentation.

• Users never spend quality time for testing, they are always pulled way by operational needs.

• Users want everything free of cost.

Most of the above concerns are generally addressed within six months of going LIVE that is during the stabilization period. It could however be a matter of concern if these issues are not resolved even a year of going LIVE with new core system; a clear symptom of flaws at strategic level than at tactical level. This necessitates a meticulous approach towards analyzing, assessing and resolving the issues, and to also put in place mechanisms preventing reoccurrence of the same issues. Critical Success Factors

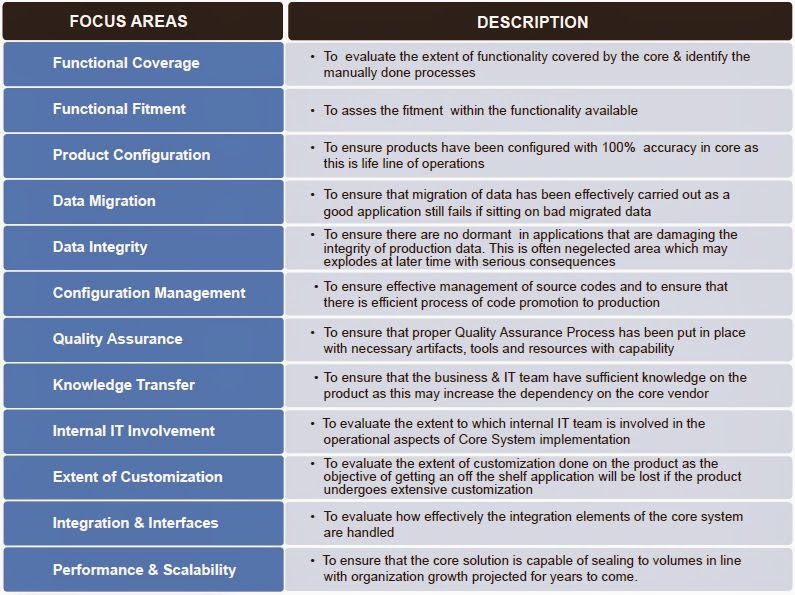

While the above table gives an indication of the focus areas that needs to be covered as a part of the evaluation process, it is not exhaustive. Depending on the outcome after initial process of evaluation there could be several other areas that should be focused as a part of the evaluation process. Evaluation Process While the section above indicates the areas that need thorough evaluation the following section covers the steps that are typically involved in evaluating each of the above mentioned focus areas.

Requirements In order to conduct a thorough evaluation, it is very important that the evaluators have complete access to information. Some key requirements are listed below: Solution

The entire objective of the evaluation process is to derive at root-cause of the issues that are hampering a smooth functioning of core insurance solutions. While the issues could be several and the root causes can be even more, a generic classification of all issues generally can be limited around 3 major areas. While there are solutions available for each of the issues categorized in the above three groups, picking up a right solution will be a herculean tasks at times. A team well balanced in its composition with adequate representation from all quarters of stakeholders need to be constituted that would ponder on each of these issues and asses its solutions based on A holistic approach needs to be designed by taking all individual solutions with responsibilities and KRAs defined. Each of the solution and the mitigation plan needs to be documented and tracked as a project by itself. Case II A leading life insurance organization in South East Asia has embarked into an ambitious transformation project with a view to replace their legacy policy admin systems with a solution built with contemporary technologies. Though the solution procured has been thoroughly evaluated for its fitment, the project has gone into serious troubles during the User Acceptance Testing (UAT) Phase. A planned UAT of 3 months got extended beyond 14 months with still no visibility of light at the end of the tunnel. Key concerns being

a) many business requirements not available in the new core insurance platform

b) business users have low confidence on the solution

c) too many defects during testing

An objective evaluation of this situation has helped the organization to discover the root causes that have brought them to this situation • Stakeholder Buy-in: Evaluation of core insurance system done without adequate involvement of business team

• Drive from the top: Top management not involved until later stages

• UAT Management: Test Management process is virtually inexistent

• Quality Gates: Poor management of quality gates in SDLC

Business Users

• System is very slow

• Transactions now involve more steps compared to legacy systems

• Reports are missing

• With the new system financial books are in mess

• Too many change requests are now being received for enhancing the software

• It worked in UAT but not in production

• The vendor fixed one problem which then reopened an older one

• Documentation/User manual is not good enough

• This is a basic requirement, yet the vendor says it’s a change request

• Introducing new products is difficult and needs code change

Common complaints from software developers

• Users do not specify their requirements in total, we always receive one line requirements

• Our application is working fine, it’s the data from legacy which is giving problems

• They agreed to use canned reports, but now they want reports in their own format.

• Users never read documentation.

• Users never spend quality time for testing, they are always pulled way by operational needs.

• Users want everything free of cost.

Most of the above concerns are generally addressed within six months of going LIVE that is during the stabilization period. It could however be a matter of concern if these issues are not resolved even a year of going LIVE with new core system; a clear symptom of flaws at strategic level than at tactical level. This necessitates a meticulous approach towards analyzing, assessing and resolving the issues, and to also put in place mechanisms preventing reoccurrence of the same issues. Critical Success Factors

We should also examine the critical factors that drive projects

towards success.

It is important to determine if one or more of the factors

have contributed to the project not meeting its original objectives.

This exercise should be seen more as an activity intended to find

the “Right Way Forward” than looking at as “Fault Finding” task.

Case I

Needless to say, the involvement of the top management in the

implementation of core insurance solutions is extremely

important. Our experience in the recent past is depicted in the

following chart. It is evident that projects where the top

management involvement was not adequate in the early stages

are forced to consume more time during the crucial latter phases.

Focus Areas

Some key areas that are to need to be critically examined to

identify the source of issues discussed are: -.

While the above table gives an indication of the focus areas that needs to be covered as a part of the evaluation process, it is not exhaustive. Depending on the outcome after initial process of evaluation there could be several other areas that should be focused as a part of the evaluation process. Evaluation Process While the section above indicates the areas that need thorough evaluation the following section covers the steps that are typically involved in evaluating each of the above mentioned focus areas.

Requirements In order to conduct a thorough evaluation, it is very important that the evaluators have complete access to information. Some key requirements are listed below: Solution

The entire objective of the evaluation process is to derive at root-cause of the issues that are hampering a smooth functioning of core insurance solutions. While the issues could be several and the root causes can be even more, a generic classification of all issues generally can be limited around 3 major areas. While there are solutions available for each of the issues categorized in the above three groups, picking up a right solution will be a herculean tasks at times. A team well balanced in its composition with adequate representation from all quarters of stakeholders need to be constituted that would ponder on each of these issues and asses its solutions based on A holistic approach needs to be designed by taking all individual solutions with responsibilities and KRAs defined. Each of the solution and the mitigation plan needs to be documented and tracked as a project by itself. Case II A leading life insurance organization in South East Asia has embarked into an ambitious transformation project with a view to replace their legacy policy admin systems with a solution built with contemporary technologies. Though the solution procured has been thoroughly evaluated for its fitment, the project has gone into serious troubles during the User Acceptance Testing (UAT) Phase. A planned UAT of 3 months got extended beyond 14 months with still no visibility of light at the end of the tunnel. Key concerns being

a) many business requirements not available in the new core insurance platform

b) business users have low confidence on the solution

c) too many defects during testing

An objective evaluation of this situation has helped the organization to discover the root causes that have brought them to this situation • Stakeholder Buy-in: Evaluation of core insurance system done without adequate involvement of business team

• Drive from the top: Top management not involved until later stages

• UAT Management: Test Management process is virtually inexistent

• Quality Gates: Poor management of quality gates in SDLC

No comments:

Post a Comment